Introduction

If you have encountered the phrase po box 55520 portland oregon pay to the order of, you are likely dealing with a financial document, billing statement, or payment instruction. While it may appear simple at first glance, this phrase carries legal, logistical, and financial significance. Understanding how payment instructions and mailing addresses work together is essential for ensuring secure and accurate transactions.

In today’s financial landscape, where digital and traditional payment methods coexist, mailing payments to a PO Box remains common—especially for businesses, institutions, and service providers. This comprehensive guide explores what this phrase means, why organizations use PO Boxes in Portland, Oregon, and how you can safely and confidently process payments.

Understanding PO Boxes in Portland, Oregon

What Is a PO Box?

A Post Office Box (PO Box) is a locked mailbox located within a post office facility. Individuals and organizations rent these boxes to receive mail securely. In a city like Portland, Oregon, PO Boxes are widely used by businesses, nonprofits, healthcare providers, and financial institutions.

Key characteristics of a PO Box:

-

Secure and locked access

-

Located within official postal facilities

-

Provides privacy by not revealing a physical business address

-

Enables centralized mail handling

Why Organizations Use PO Boxes

When you see a mailing address like PO Box 55520 in Portland, Oregon, it typically signals structured mail processing. Businesses often use PO Boxes for:

-

Payment processing

-

Customer correspondence

-

Legal documentation

-

Billing statements

-

Subscription management

Large organizations frequently outsource mail handling to specialized payment processing centers. These facilities collect mail from the PO Box multiple times daily and route checks into automated systems.

Security and Operational Advantages

Using a PO Box provides:

-

Enhanced privacy protection

-

Reduced risk of lost mail

-

Structured internal accounting processes

-

Faster batch payment handling

For consumers, this means payments are directed to a standardized processing center rather than an individual office.

Breaking Down the Phrase: “Pay to the Order Of”

The phrase “Pay to the Order Of” appears on negotiable financial instruments such as checks. It specifies the legal recipient of funds.

Legal and Financial Meaning

“Pay to the Order Of” designates:

-

The entity legally entitled to receive payment

-

The only party authorized to deposit or endorse the check

-

A binding instruction recognized by banks

This phrase ensures that:

-

Funds cannot be deposited by unauthorized individuals

-

Payment disputes can be legally resolved

-

Financial institutions can verify intended recipients

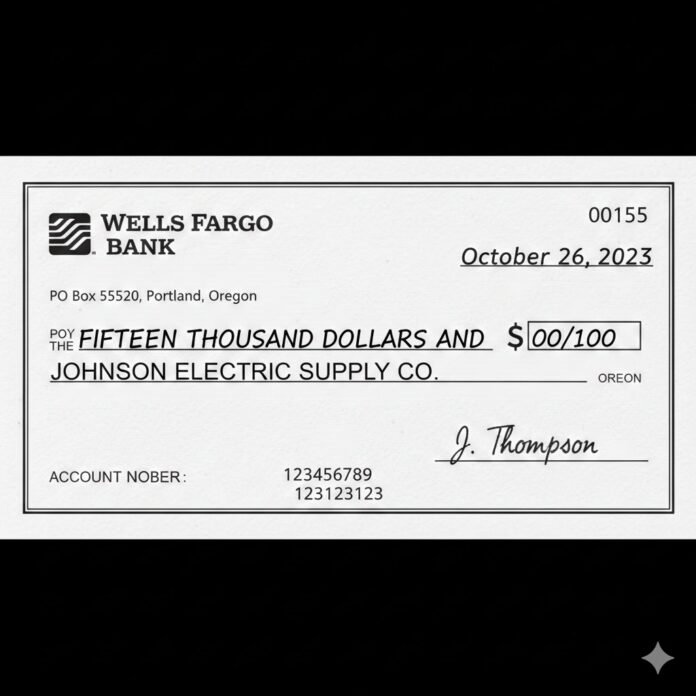

How It Appears on a Check

On a standard check, you will find:

-

Date field

-

Payee line (after “Pay to the Order Of”)

-

Amount in numbers

-

Amount in words

-

Signature line

If you are instructed to send payment to po box 55520 portland oregon pay to the order of, the critical part is the named entity after “Pay to the Order Of.” The PO Box is the mailing destination; the payee name is the legal recipient.

Why You Might See “po box 55520 portland oregon pay to the order of”

This phrase typically appears in structured billing communications. Below are common scenarios:

1. Billing Statements

Utility companies, subscription services, and financial institutions often use centralized payment addresses. The Portland PO Box may serve as a regional processing center.

2. Debt Collection Notices

If you receive a collection letter, it may include a payment instruction referencing a Portland PO Box. Always verify:

-

The collection agency’s legitimacy

-

Account numbers

-

Official contact details

3. Insurance Premium Payments

Insurance providers frequently direct premium payments to PO Boxes. This allows:

-

Batch processing

-

Faster deposit timelines

-

Centralized accounting

4. Government or Quasi-Government Agencies

Certain agencies operate payment lockbox systems where payments are processed by financial partners on behalf of the organization.

How to Safely Send a Payment to a PO Box

When mailing a check, security and accuracy are critical.

Verification Checklist

Before mailing:

-

Confirm the company’s official website lists the same PO Box.

-

Call customer service using a verified phone number.

-

Check your account number matches the billing statement.

-

Review spelling of the payee name.

Secure Mailing Practices

-

Use blue or black ink only.

-

Do not leave blank spaces on the check.

-

Avoid writing sensitive information on the envelope.

-

Consider certified mail for high-value payments.

Record-Keeping Best Practices

Maintain:

-

A photo or copy of the check

-

A tracking number (if applicable)

-

Bank confirmation of deposit

-

The original billing statement

These steps protect you in case of disputes.

Common Real-World Payment Scenarios

Understanding context helps reduce errors.

Subscription Services

Monthly service providers may request mailed payments for customers not enrolled in autopay. The PO Box ensures organized intake.

Medical Billing

Healthcare providers often contract third-party payment processors. Mailing to a centralized PO Box simplifies reconciliation with insurance claims.

Financial Settlements

Legal settlements, structured payments, or negotiated debt repayments often specify exact mailing instructions.

Business-to-Business (B2B) Payments

Corporations frequently operate accounts payable departments that receive payments at centralized lockbox facilities.

Avoiding Fraud and Payment Scams

Mail fraud and billing scams are growing concerns.

Red Flags to Watch For

-

Urgent threats demanding immediate payment

-

Spelling errors in official letters

-

Mismatched company logos

-

PO Box not listed on official website

-

Requests to make checks payable to individuals instead of companies

How to Verify Legitimacy

-

Search the company name independently.

-

Cross-check addresses via official corporate listings.

-

Confirm through Better Business Bureau records.

-

Contact your bank if uncertain.

What to Do If You Suspect Fraud

-

Do not send payment.

-

Report suspicious letters to the USPS Inspection Service.

-

Notify your bank immediately if a check has already been mailed.

Alternatives to Mailing a Check

Although mailing to PO Boxes remains common, digital options provide added convenience.

Online Payments

-

Faster processing

-

Immediate confirmation

-

Reduced fraud risk

Bank Bill Pay

Many banks offer automatic mailing services. They send checks directly to PO Boxes on your behalf.

Money Orders and Cashier’s Checks

For added security:

-

Use cashier’s checks for large amounts.

-

Keep receipts.

-

Confirm delivery.

Electronic Funds Transfer (EFT)

Businesses increasingly prefer ACH transfers for:

-

Faster reconciliation

-

Lower processing costs

-

Reduced mailing delays

Frequently Asked Questions

Can You Track Payments Sent to a PO Box?

You cannot track mail inside the PO Box, but you can:

-

Use USPS tracking

-

Monitor your bank account for check clearance

-

Request confirmation from the recipient

What If You Write the Wrong Payee?

If the payee name is incorrect:

-

Do not mail the check.

-

Void it and issue a new one.

-

Never use correction fluid on financial documents.

Is It Safe to Send Checks by Mail?

Yes—if proper precautions are taken:

-

Drop mail inside a post office rather than in an outdoor mailbox.

-

Avoid mailing from unsecured locations at night.

-

Monitor your bank statements closely.

Expert Recommendations for Handling Payment Instructions

From a financial compliance perspective, always treat payment instructions seriously. Here are professional-level best practices:

-

Verify payment details independently.

-

Avoid acting under pressure.

-

Maintain organized documentation.

-

Reconcile payments monthly.

-

Opt for digital confirmation when possible.

The phrase po box 55520 portland oregon pay to the order of represents more than an address—it reflects a structured payment workflow. Understanding how these systems operate empowers you to manage finances responsibly.

Key Takeaways

-

A PO Box in Portland, Oregon, often indicates centralized mail processing.

-

“Pay to the Order Of” legally defines the check’s recipient.

-

Always verify payment instructions independently.

-

Keep documentation for financial protection.

-

Consider digital alternatives when available.

Conclusion

Mailing a payment to a PO Box may seem routine, but it involves legal, logistical, and financial considerations. Whether you are responding to a billing statement, handling insurance premiums, or resolving a financial obligation, understanding the meaning behind structured payment instructions ensures accuracy and security.

The phrase po box 55520 portland oregon pay to the order of combines two essential financial components: destination and authorization. By approaching such instructions with informed caution and professional diligence, you protect your money, your identity, and your financial standing.

In an era where financial fraud is increasingly sophisticated, knowledge is your strongest safeguard. Use the guidance in this article to make confident, secure payment decisions every time.