Introduction

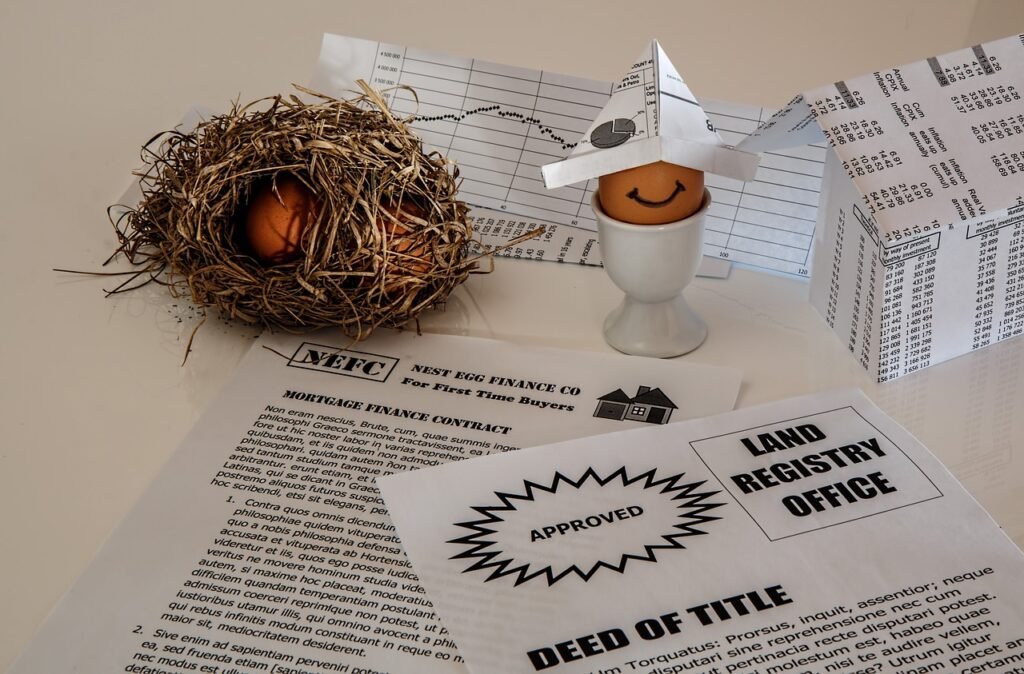

Navigating the world of loans can feel like wading through a swamp. The jargon, the endless fine print, and the hoops you have to jump through? It’s enough to make anyone’s head spin! Enter Traceloans, a concept that’s shaking up the financial landscape. Whether you’re looking to buy your dream home, start a business, or consolidate debt, Traceloans promises to make the journey smoother, smarter, and more transparent. But what exactly is it, and how can it help you?

This article dives deep into the Traceloans phenomenon, breaking it all down for you in plain English. By the end, you’ll know what it is, how it works, and why it could be your new best friend when it comes to borrowing. So, buckle up—we’re hitting the financial fast lane!

What Are Traceloans, Anyway?

At its core, Traceloans is more than just a fancy term. It’s a comprehensive system designed to simplify loan processes, ensure transparency, and give borrowers greater control. Picture this: a digital dashboard where you can track your loan’s every move, from application to final repayment. Sounds cool, right?

Key Features of Traceloans

-

Real-Time Tracking: Get updates on your loan’s status anytime, anywhere.

-

Enhanced Transparency: No more hidden fees or surprise charges.

-

Customizable Options: Tailor your loan terms to fit your lifestyle.

-

User-Friendly Interface: Accessible even for the least tech-savvy among us.

How It Stands Out

Traditional loans can feel like a black hole—you put in your application, wait for approval, and hope for the best. With Traceloans, you’re always in the loop. It’s like having a GPS for your financial journey.

How Does Traceloans Work?

You might be wondering, “Okay, this all sounds great, but how does it actually work?” Good question!

Step 1: Application

Start by filling out a simple online form. No more stacks of paperwork or endless lines at the bank.

Step 2: Personalized Loan Options

Based on your financial profile, Traceloans offers customized loan options tailored to your needs. Whether you’re a first-time borrower or a seasoned pro, there’s something for everyone.

Step 3: Real-Time Updates

Once you’ve selected a loan, you can track its progress in real-time. From underwriting to disbursement, every step is laid out clearly.

Step 4: Repayment Made Easy

Set up automated payments, get reminders, or adjust your plan as needed. Flexibility is the name of the game.

Why Choose Traceloans?

Still on the fence? Let’s explore why Traceloans might be the perfect fit for you.

1. Transparency You Can Trust

Hidden fees and unexpected costs are a thing of the past. Traceloans lays everything out in black and white.

2. Flexibility Like Never Before

Life happens, and Traceloans gets it. Need to tweak your repayment schedule? No problem.

3. Convenience at Your Fingertips

From application to repayment, everything is managed online. It’s like having a personal banker in your pocket.

Real-Life Applications

Let’s take a look at some scenarios where can shine:

Buying a Home

Dreaming of your first home? can simplify the mortgage process, ensuring you’re not caught off guard by unexpected costs.

Starting a Business

Entrepreneurs, rejoice! With Traceloans, you can secure funding without the usual hassle, letting you focus on growing your dream.

Consolidating Debt

Tired of juggling multiple payments? Use to streamline your debts into one manageable monthly payment.

Frequently Asked Questions

1. What types of loans does cover?

From personal and auto loans to mortgages and business funding, Traceloans has you covered.

2. Is Traceloans secure?

Absolutely! Robust encryption and advanced security protocols ensure your data stays safe.

3. How do I get started?

Visit the Traceloans website, fill out an application, and explore your options—it’s that easy!

Pros and Cons of

Pros

-

User-Friendly Interface

-

Enhanced Transparency

-

Customizable Loan Options

-

Real-Time Updates

Cons

-

Tech Dependency: If you’re not comfortable online, the system might feel overwhelming.

-

Availability: Not yet widely available in all regions.

Conclusion

Traceloans is more than a buzzword—it’s a revolutionary way to approach borrowing. By combining transparency, flexibility, and convenience, it transforms a traditionally stressful process into a seamless experience. So, whether you’re planning your next big move or just looking to manage your finances better, give Traceloans a shot. After all, who doesn’t want a loan experience that’s as smooth as it is smart?